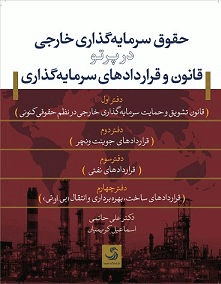

Mr. Esmaeil Karimiyan has published a book jointly with Dr. Ali Hatami. The book has been published in May 2014 in Tehran and consists of 4 chapters as follows:

1. Foreign Investment Promotion and protection Act in the Current Legal System of Iran,

2. Joint Venture Contracts,

3. Petroleum Contracts and

4. Build-Operate & Transfer Contracts (BOT).

The Book is a practical and comprehensive learning resource book in 1174 pages. The book consists of 4 Chapters and more than 300 case studies of recent Joint Venture Contracts, Oil and Gas projects Petroleum Contracts, Build-Operate & Transfer Contracts (BOT), EPC, EPCF, EPC&F, EP, EC and PC Contracts, Loan Agreement and Project Financing instrument, Sales Contracts, Agency Contracts, Distribution Contract, Outsourcing and Management Contracts… in Iran and other countries. This book, however, is not merely another addition to the available literature. It has a marked distinction. It not only comprises theory and practice in one place, but also provides a new trend in respect of interpretation of International Investment & Commercial Contracts. The purpose of this book is twofold: (i) to provide new trend in respect of interpretation and comparison of the terms of International Investment & Commercial Contracts the; and (ii) to assist contract drafters in their analysis of the various kinds of Petroleum Contract. The authors of the book have a long experience of practice and research in Investment & Commercial Contracts in Iran as a drafter of contracts, lawyer, counselor and negotiator for foreign and domestic companies during past decades. Many contractual documents cited in this book and their interpretations are the result of experiences gained during the presence of foreign companies in Iran.

1. Foreign Investment Promotion and protection Act in the Current Legal System of Iran,

2. Joint Venture Contracts,

3. Petroleum Contracts and

4. Build-Operate & Transfer Contracts (BOT).

The Book is a practical and comprehensive learning resource book in 1174 pages. The book consists of 4 Chapters and more than 300 case studies of recent Joint Venture Contracts, Oil and Gas projects Petroleum Contracts, Build-Operate & Transfer Contracts (BOT), EPC, EPCF, EPC&F, EP, EC and PC Contracts, Loan Agreement and Project Financing instrument, Sales Contracts, Agency Contracts, Distribution Contract, Outsourcing and Management Contracts… in Iran and other countries. This book, however, is not merely another addition to the available literature. It has a marked distinction. It not only comprises theory and practice in one place, but also provides a new trend in respect of interpretation of International Investment & Commercial Contracts. The purpose of this book is twofold: (i) to provide new trend in respect of interpretation and comparison of the terms of International Investment & Commercial Contracts the; and (ii) to assist contract drafters in their analysis of the various kinds of Petroleum Contract. The authors of the book have a long experience of practice and research in Investment & Commercial Contracts in Iran as a drafter of contracts, lawyer, counselor and negotiator for foreign and domestic companies during past decades. Many contractual documents cited in this book and their interpretations are the result of experiences gained during the presence of foreign companies in Iran.

_Tehran_Stock_Exchange_Post-Sanctions_strategy.jpg)